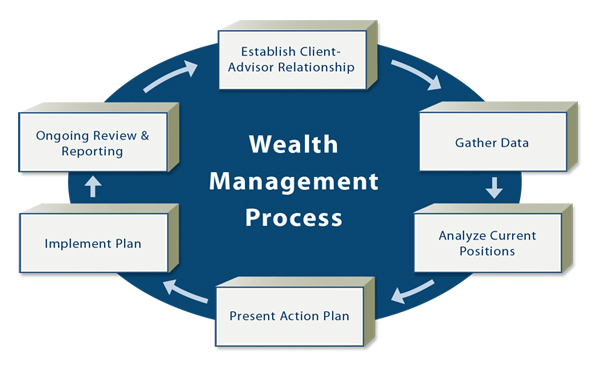

The Rein Group's Wealth Management Process is a flexible system that supports us in customizing a plan based on your unique needs and desires. It consists of six stages:

- Establish Client Relationships

In order to get to know you, we will collect relevant financial data, assess your risk tolerance, and determine your financial goals and needs. All future decisions in the Wealth Management Process will stem from this information.

- Gather Data

We will identify your principal needs and work with you to prioritize both short- and long-term goals.

- Analyze Existing Positions

In an "observations meeting," we will assess your current accounts and policies, looking closely for gaps or inconsistencies.

- Present an Action Plan

Depending on your situation, we will draft a financial plan that may include an Investment Policy Statement, a thorough retirement income plan, or a detailed action plan.

- Implement Plan

At this stage, we will make specific decisions regarding which financial tools are best for your situation.

- Ongoing Review and Reporting

The final step in the Wealth Management Process involves the ongoing monitoring of your portfolio to maintain appropriate diversification of your assets. Although diversification does not assure a profit or protect against a loss in declining markets, The Rein Group will make every effort to keep your objectives on track.